Think You're Paying too much in Taxes?? You might be RIGHT. .

You have until September 20th to file your tax assessment complaint with Peoria County.

STEP 1: Find & calculate your market value according to Peoria County.

Visit: https://66.99.203.101/assessor/realasp1.asp

Make sure the YEAR is 2016 (use drop down box). You will need your property tax ID #. This is a 10 digit # found on your tax bill. Having trouble locating your tax ID #? We can help, just reach out to The Knell Group!

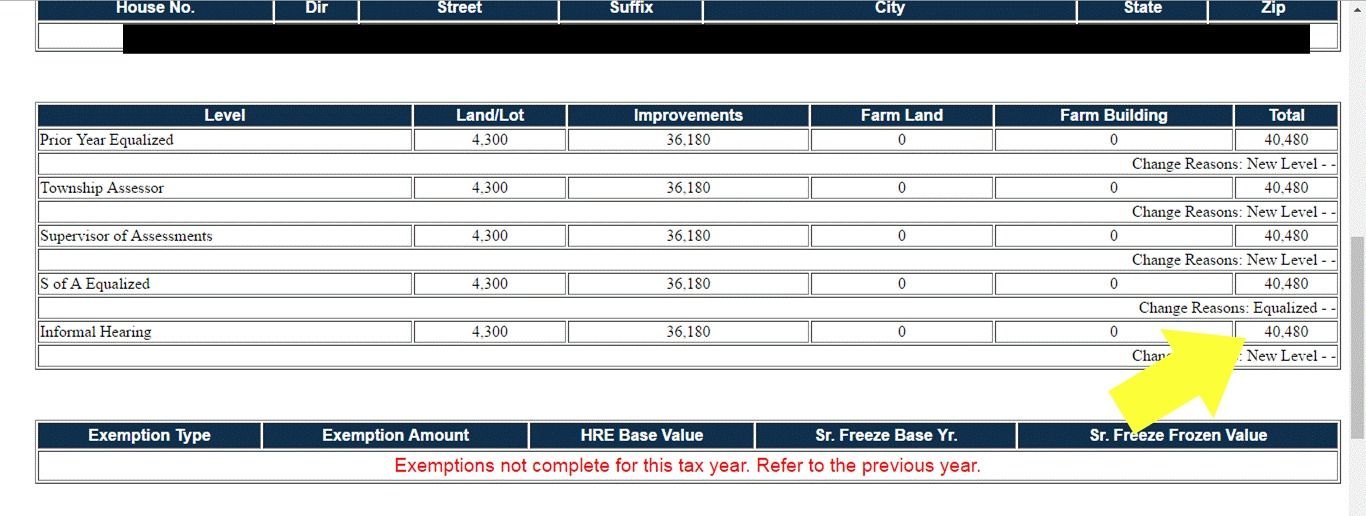

After entering your tax ID# and hit SUBMIT, your information should populate. Scroll to mid-page and find the heading Level | Land/Lot | Improvements | Farm Land | Farm Improvements | Total.

The bottom number is your assessed value ( or 1/3 of your market value).

To calculate your market value, multiply the assessed value by 3. EXAMPLE BELOW: 40,480 x 3 = $121,440 market value.

STEP 2: Investigate & decided if your assessed value/market value is grossly over calculated. Consider location, area sales & your home's features/improvements. Not sure? Contact The Knell Group for help here!

STEP 3: If you wish to dispute visit: https://www.peoriacounty.org/assessmentsupervisor/complaint/

It is strongly recommended that the taxpayer discuss his/her assessment with the Township Assessor prior to the filing of a complaint with the Board of Review. If, after talking with the township assessor, the taxpayer still wishes to pursue a formal complaint, he/she needs to familiarize themselves with the Rules governing hearings before the Peoria County Board of Review. However, the 30 day time limit for filing from the date of publication will not be changed to allow for discussing the assessment with the township assessor- Peoria County Government

Here you will need to download the complaint packet, read the rules, fill out the complaint form section & the schedule section. Gather all required documentation & submit. The county will schedule a hearing that cannot be re-scheduled so either you must attend or they will base their decision off the information at hand during the hearing.

** TIME IS OF THE ESSENCE **

Want to understand how the assessment process works and why it matters to you? Click here: